The Government is making available free money to first-time buyers who want to secure their own homes.

The question is:

“Where do I sign up for this free money, and how do I go about to claim it?”

ALMOST R600 MILLION RAND AVAILABLE

In a recent media release Mr Mbulelo Tshangana, the Director General of the Department of Human Settlements, Mr Tshangana stated that the Government has budgeted almost R600 million to aid first-time buyers to gain access to owning their own homes.

The aim is to provide assistance to some 20 000 beneficiaries under the FLISP subsidy programme.

IS THIS SUBSIDY AVAILABLE TO EVERYONE?

The Finance Linked Individual Subsidy Programme (FLISP) is available to all first-time home buyers who earn a gross income between R 3 501.00 and R 22 0000.00 per month.

To qualify, a buyer must further be a South African citizen with a financial dependent, and must have obtained an approved home loan.

The subsidy is also only available if you have not yet taken transfer of your new property, unless you live in the Western Cape or Kwa-Zulu Natal in which instance you can submit a claim within a certain time frame as an existing home owner.

The subsidy is linked to the gross combined household income and works on a sliding scale according to the income of the buyer. The maximum subsidy amount is R 121 626.00, and the minimum subsidy amount is R27 960.00.

STAKEHOLDERS IN THE PROPERTY INDUSTRY STAND TOGETHER TO AID FIRST TIME BUYERS

That is why we teamed up with LexisNexis, says Meyer de Waal, a conveyancing attorney of MDW INC in Cape Town.

We realized that in the 2019/2020 financial year, the National Housing Finance Corporation who processes the majority of FLISP applications only received 2 815 flisp applications, and approved some 2 120 applications to a value of R111 million.

This was confirmed in a recent media statement released by Minister of Human Settlements Water and Sanitation, Lindiwe Sisulu

The number of applications received is far off the target of 20 000 beneficiaries to be assisted.

NEVER HEARD OF A FLISP SUBSIDY

Our FLISP support service receives daily calls from existing new home owners who are upset that they were not informed that they had access to the FLISP subsidy funds before they took transfer of their properties on the their names.

Once they have taken transfer, they cannot submit a retrospective FLISP subsidy application.

Conveyancing attorneys are the last stakeholder to engage with a new home buyer before the transfer is registered in their name.

We realized that the wide distribution network of LexisNexis, who provides conveyancing software to thousands of conveyancing attorneys, will be the ideal partner to work with.

IS THIS MONEY AVAILABLE TO EVERYONE?

Yes it is, but there is a proviso that may prevent a first time buyer to apply for the subsidy.

The proviso is that as the subsidy is “finance linked”, it means that the first time buyer must first qualify for a financial loan.

At this moment only home loans from the traditional financial institutions such as ABSA, FNB, Standard Bank, Nedbank and SA Home Loans qualifies to be linked to a FLISP subsidy.

One would think that with the current low interest rates, first-time buyers would qualify easily for a home loan, says Anele Matakane, who assists home buyers with their FLISP applications as well as home loan applications.

The impact of a credit score often prevents many buyers from raising a home loan.

A credit score can either be “low” or “bad”, “average”, or “good”, up to “excellent”.

Many buyers do not have a credit profile at all, as they want to avoid a debt trap and pay cash for all their expenses.

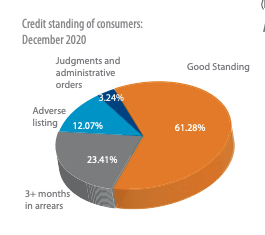

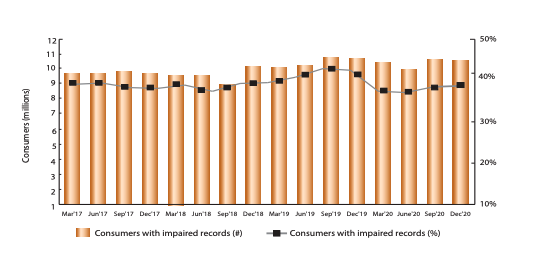

The impact of Covid-19 worsened the credit profiles of many consumers in South Africa, and many first-time buyers were left without income for a few months at first. This resulted in many credit accounts not be paid up-to-date, with the result that many consumers are faced with credit profiles that indicate late or non-payments towards their accounts.

According to statistics received from the National Credit Regulator, the payment history of consumers deteriorated towards the end of 2020 and in 2021, many consumers are still struggling to improve their credit profiles.

THE IMPACT OF A CREDIT SCORE

A credit score is the gateway to convince a financial institution to grant you a home loan.

The credit profile provides information to a financial institution if the client has the propensity and actual means to meet credit payments on time.

If your history demonstrates “low” or a bad payment profile or over indebtedness, then it may be difficult to obtain approval for a home loan, due to the strict interpretation of the National Credit Act that aims to prevent reckless lending.

Matakane explains the various credit profiles:

A “thin” credit profile:

Many first-time buyers do not have any credit store accounts and pay cash for all the expenses.

The result is that there is no history of credit management and payment.

It is regarded as a “thin” credit profile.

If to approach a financial institution for a home loan, the lender has no information to reflect back on how the consumer manages his or her credit. It is such unlikely that a first time buyer with a thin credit profile will convince a bank to grant a home loan to a buyer with a thin credit profile.

We have to guide and educate the buyer how to open a credit account, usually a store account and manage their purchases and repayment on a structured and responsible manner.

It may take a few months.

It is time consuming, but the rewards are fantastic and the end result can be to own your own home and qualify for a FLISP subsidy.

Read more how Mary took time to build up a credit profile and at the age of 58 years old purchased her own home says Matakane.

Bad or low credit profile

A homebuyer with a low or bad credit score will most likely not qualify for a home loan.

Such credit profile will indicate to the financial institution that the consumer had in the past and still may even struggle to meet regular credit payments.

We then advise the consumer to undergo a budget fitness program and over time restore and build up the credit score again.

All is not lost for this home buyer, we usually explain that the home buyer journey is just delayed while we assist to improve the credit score of the aspiring buyer.

“A comprehensive budget fitness service is available to guide and assist these consumers and continue with the home ownership journey a bit later” says Matakane.

An average credit profile:

Our experience is an average credit score will not be the best credit score to use as motivation to a for a home loan application as it still shows a little bit of weakness in the credit behaviour of the consumer.

The consumer may be over indebted, or not have sufficient cash flow in his or her budget after payment of debt obligations and living expenses.

The result may be that if a home loan is approved, the bank might add one or two percentage points to the interest rate of the home loan rate.

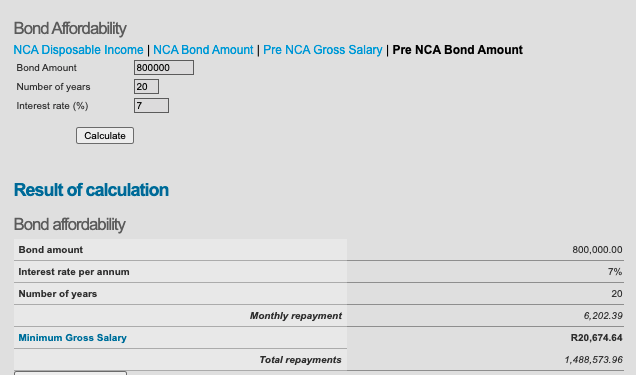

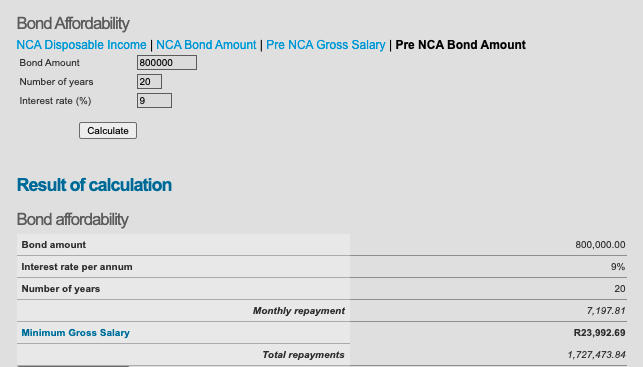

With the current prime lending rate of 7%, it is not unusual to end up with a home loan rate of prime plus 2%.

This may cost you thousands of Rands in the long run says De Waal, as it could take up to 20 years to pay off a home loan.

We have done calculations that if you pay 2 % more that the prime rate, your home loan can cost to +/- 31% more over 20 years.

We did the calculations on a home loan of R 800 000.00 paid off over 20 years and calculated as follows:

| 7 % interest | Plus 2% = 9 % interest |

| Total repayment over 20 years @ 7% = R 1 488 573.96 | Total repayment over 20 years @ 7% =R 1 727 473.84 |

| Difference – | More paid : R 238 899.88 |

The result is that 2% extra that is added to a home loan interest rate will cost the home buyer 31% for the property purchased.

HOW DO YOU AVOID THAT?

The question is, how do I impress the bank to give me the best interest rate when my credit score is average?

The best advice we have is to get your budget fit, and then apply.

Another suggestion will be – use your available FLISP subsidy as a deposit.

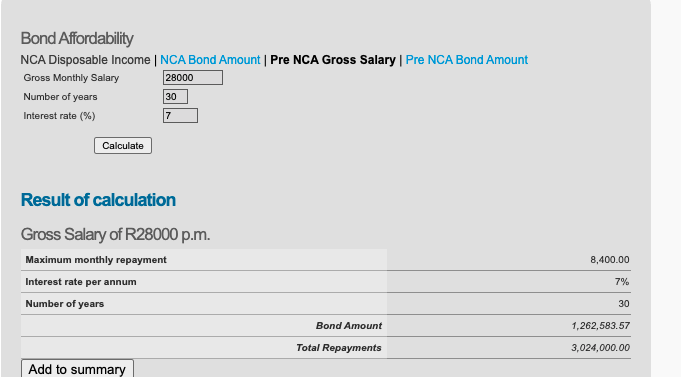

To qualify for a home loan of R 800 000.00, a buyer needs to earn +/- R 20 700.00 per month, calculated as follows:

MAKING FULL USE OF A FLISP SUBSIDY

On an income of R 22 700.00, a first time buyer can qualify for a R 34 205.00 FLISP subsidy.

If the subsidy is used as a deposit, then the buyer can apply for a lower home loan.

A financial institution favours home loan applications with a deposit and will most likely grant a home loan with a lower interest rate, compared to a 100% home loan for a buyer with an average credit score.

The result will be as follows:

| Purchase price | R 800 000.00 |

| Less FLISP subsidy | -R 34 205.00 |

| Home loan amount | R 765 795.00 |

| Balance purchase price | R 0.00 |

Also read – How one can save R59 000.00 when buying your first property.

Good or excellent credit profile

A good or excellent credit score is the best score that can accompany a home loan application.

A home buyer will have the best opportunity to negotiate the lowest home loan rate with a good or excellent credit score.

Boost your purchase power:

Over and above that, the FLISP subsidy can also be added to the home loan obtained and increase the purchase power of the first time buyer.

Working on the same home loan of R 800 000 and subsidy of R 34 205.00 here is how the increased purchase power of the buyer can look like:

| Purchase price | R800 000.00 |

| PLUS FLISP subsidy | R34 205.00 |

| Total Purchase power | R834 000.00 |

This amounts to an increase of R68 410.00 in purchase power says Matakane, if you ensure that you apply for a home loan and put your “best foot forward” with a good or excellent credit score, affordability to match, combined with a FLISP subsidy.

The conclusion is that the almost R 600 million to be made available will be a fantastic opportunity to enable beneficiaries of the FLISP subsidy grants to acquire their own homes.

Check if you can qualify – click here

FLISP Website https://flisp.co.za/

Meyer de Waal

21 May 2021