Some property experts will share their “property secret” with you; and give you their best property TIP.

This TIP is:

“You do not make money when you sell a property,

but you make your money when you buy your property.

First time buyers now make up more than 56% of property buyers.

A first-time buyer may ask – “How do you find properties with below average market prices before the seasoned property buyers get their hands on them, that are selling for R59 000 less than market price?

The answer is simple – This unique opportunity to pay up to R 123 000.00 less for a property is available for all first-time home buyers.

These savings are now available at a new development The Glen, launched by Devmark and marketed by MDW INC.

There are various types of units available, priced between R640 000.00 to R895 000.00.

To receive a brochure of The Glen development and units available, register your interest here.

HOW TO SAVE THOUSANDS AS A FIRST TIME BUYER

Many first-time home owners are not aware of this unique opportunity to save thousands of Rands.

We recently hosted an online session with a company called Between10&5, the leading platform for the creative industry in South Africa.

The focus of this online session was to engage and explore with the members of the creative industry on the topic, “why is it so difficult for a creative & entrepreneur to convince a bank to grant a home loan to them?”

The interesting fact that came out of the session of over 600 subscribers was that only 5% of the subscribers were aware that they may qualify for a Government FLISP subsidy.

“A second survey for a company who provided financing of R1 billion to their employees to purchase their own properties was conducted. Out of 45 applicants who are first time buyers and whose home loans were approved, only four of these potential home owners knew about available FLISP subsidies,” says Meyer de Waal, the founder of My Bond Fitness and a director of MDW INC Attorneys.

THE SECRET TO SAVING THOUSANDS OF RANDS WHEN YOU BUY

The concept of Finance Linked Individual Subsidy Programme, in short FLISP, is no longer a secret, but as so few home buyers are aware of it, it appears still to be an industry secret.

Buyers who qualify for such subsidies can save thousands of Rands on the purchase price of their dream home, or reduce their home loan and save thousands during the usual 20- or 30-year home loan repayment period.

THE SAVINGS

We did a few calculations on how a FLISP subsidy can reduce the purchase price for a first-time buyer.

The subsidy can be used as a deposit to reduce the actual purchase price the buyer will pay.

This subsidy can also be added to an approved home loan to enable the buyer to buy a more expensive property.

PAY 59 000.00 LESS FOR YOUR PROPERTY

We used an income a buyer who earns R 15 500.00 per month and calculated a home loan repayment over a 30-year period of time at an interest rate of 7.75 % [considering the prime lending rate is 7% at the moment.

Based on such information, the buyer may qualify for a property purchase price of R 649 000.00

A FLISP subsidy of R 59 000.00 will be available.

The result is that the buyer pays R590 000.00 for a R649 000.00 property – which means R59 000 less for the property.

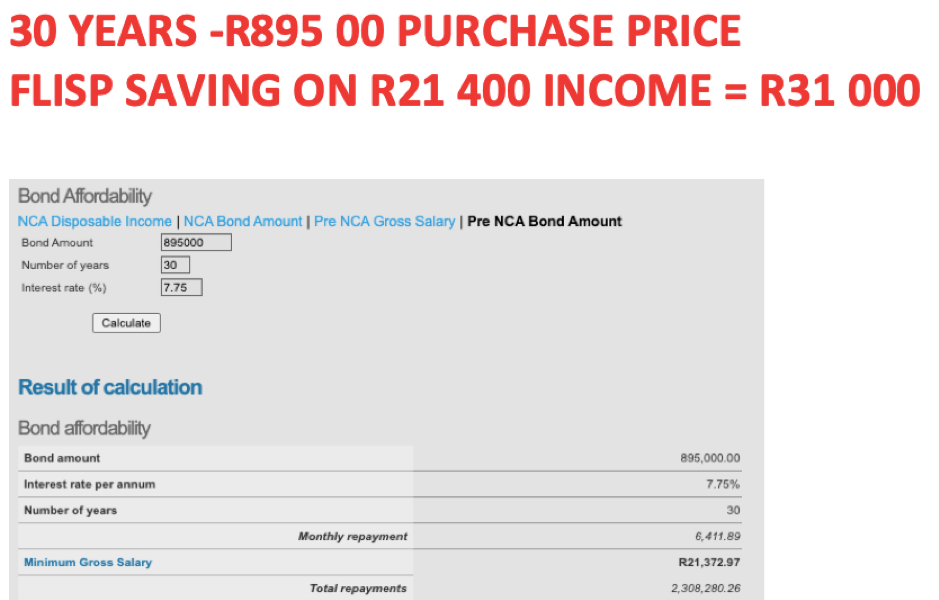

PAY R 31 000.00 LESS FOR YOUR PROPERTY

We used an income of a buyer who earns R21 400 per month and calculated a home loan repayment over a 30-year period of time at an interest rate of 7.75 %, considering the prime lending rate is 7% at the moment.

Based on such information, the buyer may qualify for a property purchase price of R895 000.00.

A FLISP subsidy of R31 000.00 will be available.

The result is that the buyer pays R 864 000.00 for a R 895 000.00 property – which means R31 000 less for the property.

HOW DO YOU QUALIFY FOR A FLISP SUBSIDY?

There are a few requirements to qualify for this subsidy, says Anele Matakane of My Bond Fitness, a company that assist home buyers with their FLISP subsidy and home loan applications.

These requirements are:

- An approved home loan application;

- at this stage only home loans by the four “big” banks are recognized for a FLISP subsidy, such being ABSA, FNB, Standard Bank and Nedbank;

- You must earn between R 3 501.00 – R22 000.00;

- based on the combined household income of the applicant/s;

- You must have a financial dependent;

- such as a spouse or a child;

- You must not have owned a property prior to the subsidy application;

- The buyer must be a South African Citizen.

The subsidies are available on a sliding scale, which means that a person who earns R 3 501.00 per month can qualify for a subsidy of R 121 626.00.

A person who earns R 15 000.00 can qualify for a subsidy of R63 000, and a person who earns R 22 000.00 can qualify for R 27 960.00.

To calculate a FLISP subsidy, use the handy FLISP Subsidy calculator.

Buyers can also establish if they can qualify for a subsidy and complete an online survey.

For more information, go to the FLISP website.

Meyer de Waal

14 September 2020